![]() Subscribe Now to My Newsletter (Join 5,000 Subscribers!)

Subscribe Now to My Newsletter (Join 5,000 Subscribers!)

**************

Welcome! If this is your first time on my blog, check out these top blog posts, too:

- My Interview with Francis Chou

- 22 Investing Lessons From Jason Donville

- How to Find Tenbaggers

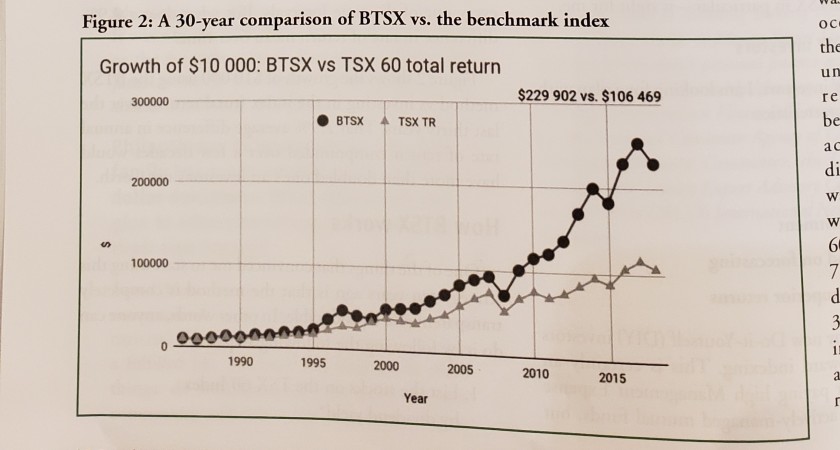

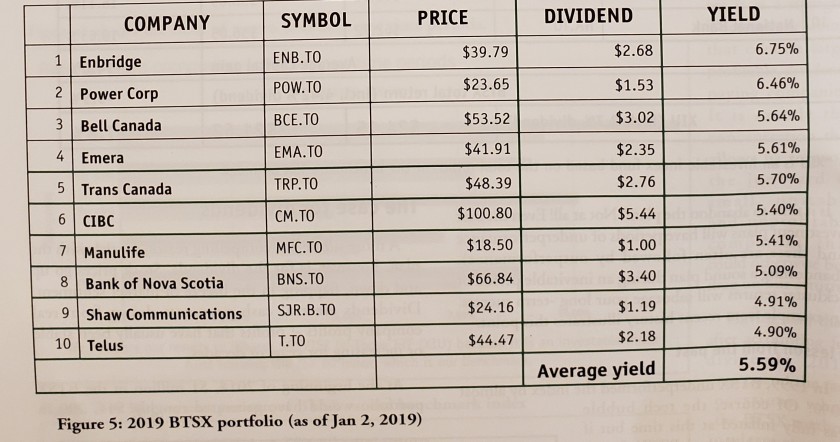

- Beating the TSX (BTSX)

- How I Pick Winning Stocks

- Canadian Capital Compounders

- Next Capital Compounders

- Small Companies; Big Dreams – Future 60 MicroCaps

***PLUS Email Me Now for a FREE copy of my new book – Capital Compounders***

**************

How I Built a $300,000 Stock Portfolio Before 30 (And How You Can Too). My 8-Step Wealth Building Journey

>>>You can also listen to my 8-Step Wealth Building Journey on My YouTube Channel

>>>You can also listen to my 8-Step Wealth Building Journey on My YouTube Channel

When I was 12 years old I made a decision. I was going to be rich. I looked up to successful people and wanted what they had: financial freedom. They seemed to be happier than everyone else. But who was I kidding? Becoming rich would be an uphill battle. I was from a middle-class family of humble means. There was no trust fund. And my parents didn’t have work connections to land me my first job. The odds were stacked against me. But I still made the decision to be rich and started on my wealth-building journey. And the path I chose to get me there: do-it-yourself investing “DIY Investing”.

Today, I manage a $300,000 stock portfolio. I’m 29 (almost 30). And my stock portfolio grows by the day. My goal is $1,000,000 in stocks by the time I’m 35 years old. I’ll show you my 8-step wealth building journey and share how you can build wealth by investing in stocks too. Read on…

When I was 12 years old I made a decision. I was going to be rich

How I Became a Do-It-Yourself (DIY) Investor:

1) Study Successful Investors

I realized that if I wanted to make money by investing in stocks I had to study successful stock investors. Common sense, right? Isaac Newton said it best:

“If I have seen further than others, it is by standing upon the shoulders of giants.”

So, from age 12 to 18, I read around 50 books on the topic.

These were the six most important investing books for me:

- The Intelligent Investor – It was through Benjamin Graham’s The Intelligent Investor that I was introduced to value investing, and the important concepts of Margin of Safety, Mr. Market, and Intrinsic Value. Warren Buffett called it “the best book on investing ever written”.

- Common Stocks and Uncommon Profits – Philip Fisher opened up my world to growth stocks. It was after I read Common Stocks and Uncommon Profits that I started paying more for stakes in higher quality, and faster growing businesses.

- One Up On Wall Street – There are so many easy-to-implement lessons shared in One Up On Wall Street. But what really stuck with me was Peter Lynch’s focus on ‘buying what you know’. That has saved me from many dog stocks in the market.

- Market Wizards – Jack D. Schwager introduced me to some of America’s top traders in Market Wizards. But instead of telling us their favourite stock picks (what they buy) he explained their investment frameworks (why/how they buy).

- Buffettology – There are many books that endeavor to explain how Warren Buffett invests in stocks but most come up short. Buffettology is the book that gets it right.

- The Money Masters – A classic that is fun to read. The Money Masters shares winning strategies from some of the world’s best investors who ever lived. It’s a book that I’ll read every couple of years to brush up on investing essentials.

I would also study Forbes’ list of the 500 Richest People in the World and Canadian Business’ Richest Canadians. It then all became very clear to me. I could become rich by earning money, saving the proceeds, and investing in stocks as other rich people, such as Warren Buffett, had done before me.

It then all became very clear to me. I could become rich by earning money, saving the proceeds, and investing in stocks

2) Earn and Save Money When You Are Young

I had opened my first bank account when I was about 8 years old. As you can imagine there wasn’t much there; cash from birthdays, Christmas, and some chores. Maybe $500 in total from what I can remember. I had to earn/save more money fast! So I did what Warren Buffett had done at my age – delivered newspapers. At 12, I joined PennySaver and became a paperboy for three neighborhoods in my hometown of Mississauga. I deposited each paycheque, along with any other money, straight into my savings account.

3) Understand How to Compound Money

Once I turned 14, and just started high school, my savings account had grown to about $5,000. At that point, I wanted to invest in stocks. But because of my age I wasn’t eligible to open a brokerage account. So I started with bonds. After returning home from the bank, I placed those newly purchased Canadian Savings Bonds into a small but sturdy wooden box, hiding it safely under my bed. I was so proud. I knew that my bonds would generate interest for me on the principal amount ($5,000). “Compound interest is like magic”, I thought. “And the earlier I started investing money the longer my money would compound (‘work’) for me”. Throughout high school, I would work several odd-jobs (mechanic shop janitor, meat department clerk, and Best Buy associate), all the while saving money from each paycheque, and then buying more bonds to further compound my money.

“Compound interest is like magic”, I thought. “And the earlier I started investing money the longer my money would compound (‘work’) for me”

4) Invest in Stocks for the Long Run

I turned 18, and was ready to enter University (party time! — NOT). In September, 2005, I moved into my “cozy” on-campus dorm room at the University of Waterloo. But even more exciting was that I finally opened my first brokerage account. By investing in stocks I could compound returns through both capital appreciation (i.e., stock price goes up) and dividend income (i.e., quarterly dividends from companies). I had already cashed out of my bonds; $10,000. So I invested that money evenly into 5 stocks, owning a $2,000 stake in each company. I felt like a true capitalist. This is how my idols, Benjamin Graham, Philip Fisher, Peter Lynch, and Warren Buffett, got rich; by investing in stocks. As I earned money though UW co-op job placements (which I recommend to every young person!), and bought more stocks, my portfolio grew, and grew, and grew. I was on top of the world. And then the financial crisis (’08) happened…

By investing in stocks I could compound returns through both capital appreciation (i.e., stock price goes up) and dividend income (i.e., quarterly dividends from companies)

5) Capitalize on Crises in the Market (i.e., Buy Low When You Can)

I was 21 years old when the entire world ended in 2008 (or so most people thought at the time). The financial crisis thrust economies around the world into recession. Stock markets collapsed. And my stock portfolio imploded. I suffered around a 50% decline from peak to trough. The financial press was all doom and gloom. “Sell! Sell! Sell!” Most people were scared and converted their stocks to cash. So I invested all of my savings into my existing stock holdings (crazy, right?). When I pulled the trigger I was scared stiff. But I’m glad I made that move as my stocks would soon rebound, pushing above pre-financial crisis highs into the years to come. I bought quality stocks on sale. 50% off! Was I a young genius; able to time the market? Nope. I simply learned from Benjamin Graham, the father of value investing, that economies and markets operate in cycles. Therefore, an investor could capitalize on manic markets, rather than become fearful and flee.

When I pulled the trigger I was scared stiff. But I’m glad I made that move as my stocks would soon rebound, pushing above pre-financial crisis highs

Indeed, 2009 was a great year to be a value investor. I would make a similar move in February, 2016 to capitalize on a bear market in Canadian stocks where the TSX declined close to -25% from its high in September, 2014. Why so confident? I know that the average bear market (on the TSX) has declined -28%, lasting 9 months, while the average bull market has advanced +124%, lasting 50 months. Based on this historical evidence then since 1956, I should eventually be rewarded in the long run when I take on “risk” (i.e., investing in cheaper stocks) during bear markets. As Warren Buffett said:

“Be fearful when others are greedy and greedy when others are fearful.”

6) Manage and Refine Your Stock Portfolio

In 2010, upon graduating from the University of Waterloo, I had about $50,000 in my stock portfolio. More money than any of my friends. This was certainly an inflection point for me as the magic of compounding started to take real effect and I was just about to enter a full time career and earn a much bigger paycheque (plus bonus), which meant more money for stocks. By 2013, three years into my first full time job, my portfolio had grown to about $125,000. However, I realized that I could build wealth faster if I compounded returns at a greater rate. So, at 25, I made it my mission to build a portfolio that actually beat the market. I started watching BNN Market Call, re-reading the best investing books, and magazines (Money Sense, Canadian MoneySaver, and Canadian Business) and following the top investors from around the world. From that I re-structured my portfolio into one that I’ve comfortably maintained since.

Here’s how my stock portfolio breaks-down:

- Mispriced Large Caps

- Speculative Takeovers

- Small/Mid-Cap Capital Compounders

Mispriced Large Caps

For example, I started loading up on Starbucks stock in 2008 at around $15/share, at a time when Starbucks was oversaturating themselves in the market, with most “experts” doubting their strategy of selling high-priced coffee, especially with the financial crisis looming, and new entrants in the coffee business, such as McDonalds. However, when I bought Starbucks stock, after their huge decline on the market, I never witnessed a drop in traffic among the stores nearby me. Starbucks had huge competitive advantage then and now. I thought, “If Starbucks goes out of business, that’s probably when the world will end”. And, seriously, do you think business people would ever switch their coffee meetings from Starbucks to McDonalds?

Speculative Takeovers

I also dabble in speculative takeovers. When Lowe’s first bid for Rona fell through, I bought a stake in Rona, and just sat on the position. I speculated that Lowe’s, or another company (maybe Home Depot), would eventually scoop up Rona, with the Quebec Government’s approval of course. When Lowe’s came back years later, bid on Rona a second time, and won approval to buy them out, my Rona shares shot up ~100% in one day. Well worth the wait.

Small/Mid-Cap Capital Compounders

But the most successful ‘bucket’ in my portfolio is the Small/Mid-Cap Capital Compounders. Why? I find that as long as the intrinsic value of these businesses grow every year, so does the price of the stock. I’m actually upset when one of my ‘capital compounder’ stocks get bought out, because most of the time there’s so much more potential for growth. It forces me to go out hunting for an equally remarkable capital compounder to replace the buy-outs. You can learn more about the criteria I look for in capital compounder stocks by reading How I Pick Winning Stocks.

7) Stick to Your Investment Strategy

From my ‘quarter life crisis’ (age 25) and onwards, I continue to earn, save, and invest in stocks using the same strategy. Now, at age 29, I have built a $300,000 stock portfolio. With a bigger capital base, it’s amazing how much more rapidly my portfolio can compound. For example, a 10% return will thrust my portfolio to $330,000 next year, without adding additional capital. I say “10%” because over the long run (since 1934), the TSX has delivered a 9.8% annual compound return, despite recessions, bear markets, and world crises. But there’s no guarantee. Nevertheless, $1,000 invested in the Canadian index in 1934 would have grown to $1,595,965 by 2014 with 9.8% compound returns. That’s “magic”, in my world.

$1,000 invested in the Canadian index in 1934 would have grown to $1,595,965 by 2014 with 9.8% compound returns. That’s “magic”, in my world.

8) Always Learn and Grow as An Investor

My DIY investing journey has been fulfilling so far. But I also know that I can further improve my odds of success by continuously learning, and improving my investing craft. This is why I recently met with some of Canada’s Top Investors. 28 in total. Those Top Investors told me how they invest in stocks, bonds, and options; sharing their proven investing strategies. It was enlightening. So I decided to put all of their investment advice into a book – Market Masters. You can now purchase Market Masters in Chapters, Indigo, and Coles stores across Canada as well as online on Amazon.ca and Indigo.ca.

I recently met with some of Canada’s Top Investors. 28 in total. Those Top Investors told me how they invest in stocks, bonds, and options; sharing their proven investing strategies.

My 8-Step Wealth Building Journey (Re-cap):

1) Study Successful Investors

2) Earn and Save Money When You Are Young

3) Understand How to Compound Money

4) Invest in Stocks for the Long Run

5) Capitalize on Crises in the Market (i.e., Buy Low When You Can)

6) Manage and Refine Your Stock Portfolio

7) Stick to Your Investment Strategy

8) Always Learn and Grow as An Investor

**************

If this is your first time on my blog, check out these top blog posts, too:

- My Interview with Francis Chou

- 22 Investing Lessons From Jason Donville

- How to Find Tenbaggers

- Beating the TSX (BTSX)

- How I Pick Winning Stocks

- Canadian Capital Compounders

- Next Capital Compounders

- Small Companies; Big Dreams – Future 60 MicroCaps

**************

Robin Speziale is the national bestselling author of Market Masters, which is available at Chapters, Indigo, and Coles as well as Costco and Amazon.ca. He lives in Toronto, Ontario. Learn more about Market Masters.

You must be logged in to post a comment.