Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

(Original Interview: July 31, 2023)

You’re in for a treat.

I recently caught up with Mathieu Martin.

He’s a fellow DIY Investor (now turned Portfolio Manager) who I originally met years ago through the blog he co-founded – Espace MicroCaps.

The MicroCap world is small, and Mathieu is one of the good ones.

Now with a couple of years under his belt as Portfolio Manager of the MicroCap Fund at Rivemont Investments (based in beautiful Montreal), Mathieu has some stories to share about investing in the micro-cap space.

Enjoy 😉

***

Robin: It’s great catching up. For the readers of my newsletter, please tell us about your background.

Mathieu: Thanks, Robin. Nice to talk again. I have a somewhat unusual background. My parents were self-employed small business owners and taught me early on that you could make a living as an entrepreneur. I tried many ways to earn money when I was young, but nothing worked out. I worked for my father’s business for several years, first as a delivery man for medical equipment, then in sales, and then as a small store manager. I started playing poker in my free time and quickly developed a passion for it.

How did you become interested in the stock market?

After a few years, I had significant savings (at least for someone in his mid-20s) but didn’t know anything about investing. I didn’t go to university and had no finance background at all. One of my friends, Philippe Bergeron-Bélanger, started telling me about his investment strategy which involved buying obscure Canadian microcap companies. I was intrigued, and I quickly got hooked. I realized that, like in poker, you can win money if you find inefficiencies to exploit, and there were plenty of inefficiencies in the microcap sector.

In 2014, I started reading finance books, attending conferences, talking to other investors, and accumulating investing experience by trial and error (many errors back then). My friend Philippe invited me to become his partner in a blog he had started called Espace MicroCaps. Our goal with the blog was to share educational articles and some of our best investment ideas and to build a community of like-minded investors in Quebec.

That’s how we connected – through the blog. Good times.

Yeah fast forward a few years later, the community was thriving. We developed our network across Canada and got known for the quality of our research and stock picks. I was able to compound the capital in my TFSA at 40%+ CAGR (unaudited) during those first few years. Philippe did even better. Friends and family started to inquire about what we were doing and how they could participate.

Excellent results! And then you turned your investment success and passion into a dream job…

Yes, exactly. In 2018, we convinced Rivemont Investments, a forward-thinking asset management firm in Quebec, to launch a microcap strategy called the Rivemont MicroCap Fund. That was essentially creating a vehicle where our friends and family (at first) could invest to get exposure to our investment ideas. We were hired as outside consultants to provide fundamental research and portfolio strategy to Rivemont’s team.

What was your journey from consultant to portfolio manager?

In the meantime, I enrolled in the Chartered Financial Analyst (CFA) program. For those who don’t know, the CFA requires a university degree or four years of work experience (in any field) to allow you to enroll. Enrolling in such a demanding program without any formal education or background in finance was a significant undertaking, but I did anyway. I passed all three exams on the first try and earned my CFA charter in November 2020. That then allowed me to join Rivemont as a senior analyst and eventually as portfolio manager of the microcap strategy in December 2021.

You conquered the CFA. That’s a really inspiring story. Thanks for sharing. Tell us about your strategy at the Rivemont MicroCap Fund.

Our mandate is to invest in North American microcap stocks with a market cap of $300M or less. We focus more specifically on the Canadian market because it’s our home turf and where our network is most developed. There are about 4,400 public companies in Canada, of which about 3,500 are considered microcaps. There are a lot of opportunities to look at, and very few investors (or at least professional investors) are looking at them, which makes the sector ripe for finding mispricings.

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

With so many stocks out there – what’s your filtering methodology?

Part of what makes our strategy unique is what we avoid. The goal is to shrink the investable universe to a more manageable level and to know this universe better than most people. We typically avoid anything commodity-related (mining, oil and gas), which removes about two-thirds of the Canadian market. We avoid pre-revenue companies, largely unprofitable companies, story stocks, etc. That leaves us with about 150-200 companies we can do a great job of following more closely.

Ok so out of the ~ 3,500 micro caps trading in Canada, only around 5% are actually worth further investigation. Can you walk us through your evaluation process for these short-listed stocks?

We evaluate and rate companies on three main dimensions: business quality (moat), management quality, and valuation. We meet a lot of management teams and typically meet a company several times before investing. It’s crucial to put in the reps and take meetings with lots of management teams to become good at assessing management quality. Unfortunately, most people overpromise and underdeliver. When you can find a management team that does the opposite, you know you’ve found something special.

Makes sense. In smaller companies you place as much (or more) importance in the jockey (management) as you do in the horse (business). what’s your portfolio size and concentration?

We aim to construct a portfolio with 15 to 25 of our best ideas, with a high concentration in the top 5 holdings. Currently, our top 5 collectively represent over 60% of the assets under management in the strategy.

What about industry breakdown?

We are also very concentrated in terms of industries. Technology and healthcare make up about 80% of the portfolio, with the rest split between consumer goods, finance, and industrial. We are bottom-up investors, so the only reason for being concentrated in two primary industries is simply because we tend to find high-quality companies that meet our criteria mainly in these two sectors.

What’s your edge over other funds investing in small companies?

An important aspect that differentiates us from other microcap funds in Canada is that we try to invest in the smallest and most illiquid companies out there. While most other small/microcap funds will typically focus on the $100M to $1 billion market cap range, the median market cap of our portfolio companies is $34M (and about $40M on a weighted average basis). That allows us to find great companies early and generate outsized returns when we are right.

Tell us about the biggest winner in the fund.

Our biggest winner since the fund’s inception was Xebec Adsorption (spoiler alert: the company is now bankrupt). We found it back in 2018 at an investor conference, and it was later recommended to us by a smart investor in our network. The company sold bio-gas upgrading equipment to produce renewable natural gas.

The market cap was about $40M back then, and the company had recorded $15M in revenue the previous year (2017). In May 2018, they announced a large order from a group in Europe for $51M over three years, which more than doubled the revenue run-rate and provided huge validation of their products and technology. The stock barely moved in the following weeks, and we started accumulating a position. Then the discovery happened.

The company continued announcing new sales and aggressively grew its revenue over the next few years. Several analysts from investment banks started to launch coverage on the company, and all the funds and cleantech ETFs began to pile in.

In 3 years, they basically went from 0 analyst coverage to 10-15 analysts and from a valuation of 2-3x EV/Revenue to 10-15x, on top of growing their revenue 300-400% during that period. The market cap almost reached 2 billion $ at the peak and was a 16-bagger for us. At that point, we felt the stock was extremely overvalued and priced for perfection. We were fortunate enough to realize that and took a lot of profits on the way up and also on the way back down when the company started to miss expectations. In aggregate, including the warrants from financings we participated in, the company was roughly a 10-bagger on our invested capital.

What ultimately went wrong at Xebec Adsorption?

After we sold, the company had several operational issues and cost overruns on its projects, which led to severe financial difficulties and a turnover of the whole management team. It ultimately went bankrupt in late 2022.

What are the biggest takeaways from your biggest winner? It obviously wasn’t a long-term hold (as you would have hoped) but you were fortunate to lock-in those gains as you closely followed the company’s performance.

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

The main takeaways for me were:

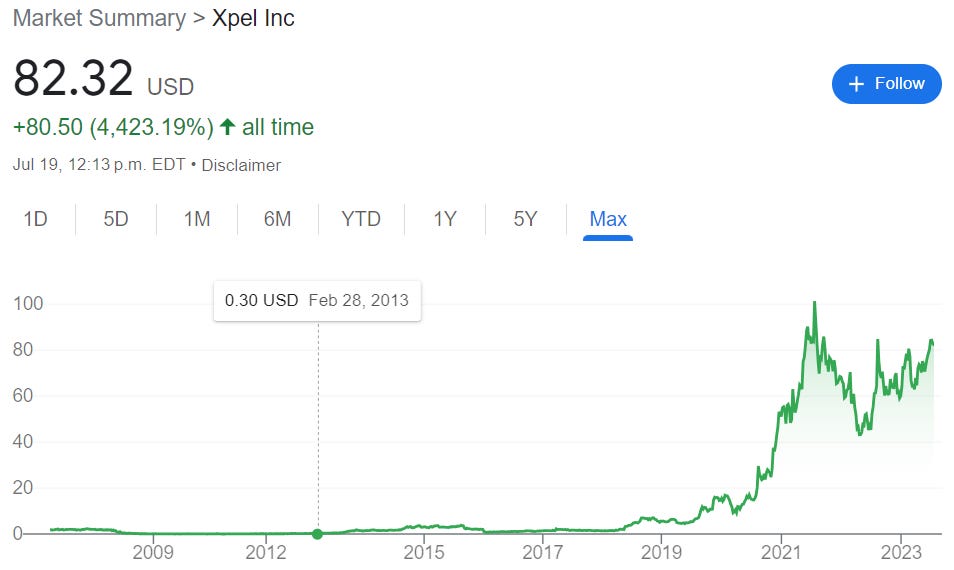

1) It is extremely rare to find a company that will execute year after year and become a much bigger company sustainably, like XPEL, for example (we don’t currently own it). Most microcaps will have a few good years and then encounter challenges that will break them.

2) You always have to monitor microcaps and reassess if your thesis is still unfolding as you expect. Don’t be afraid to change your mind when you see cracks starting to appear.

3) You must be willing to sell (at least some) and take profits when the valuation is overvalued. Take that capital and funnel it to smaller, more undervalued and undiscovered ideas.

Although I expected to hold Xebec for several years and saw the potential for them to be worth several billion $ in market cap eventually, I had to change my mind quickly when the thesis changed. That’s how we got a 10-bagger out of a now-bankrupt company. Some luck, some skills and a great timing.

Let’s look forward. What’s your favourite ‘punch-card idea’ now? If the stock market closed today and you had to choose one stock for the next 10 years…

My favorite investment idea by far right now is Kraken Robotics (TSX-V: PNG – we own the stock, and this is not investment advice). Kraken is a marine technology company providing complex subsea sensors, batteries, and robotic systems for exploring our oceans.

How long have you owned Kraken Robotics?

It’s a company we’ve owned since the early days of the microcap strategy. At the time, the company had generated $3.5 million in revenue in its most recent fiscal year (2017). Five years later (2022), the company posted revenues of $41 million with an EBITDA of $5.3 million.

Kraken also has a substantial backlog for the coming years, having announced more than $120 million in new contract wins in the last eighteen months.

Earlier this year, the company provided guidance for 2023. They forecast revenue of $66 to $78 million this year with an EBITDA of $12 to $17 million, representing revenue growth of 76% and EBITDA growth of 275% at the mid-point of the guidance ranges. We have been highly impressed with the execution of the business plan since we started following the company, and we believe that Kraken still has a lot of room to go.

There’s been some recent softness in the stock price…

The stock is currently depressed because we suspect the founder (now retired) is selling part of his position in the market, which creates substantial downward pressure on the stock. Our research leads us to believe that there are no negative fundamental reasons why he would be selling.

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

What’s your outlook for the company?

We model 2023 at the high end of the guidance ranges and believe the company currently trades at only 5-6x forward EV/EBITDA. We believe this is incredibly cheap for a company with these growth metrics and a track record of execution. Again, this is only our opinion and not investment advice – please do your own research.

What about the ever-important aspect of risk management? Explain your approach, including why/when you sell stocks in the fund.

I touched on it in the Xebec case study. The main reasons why we reduce our positions or sell completely are the following:

1) The investment thesis deteriorates.

2) The stock gets extremely overvalued.

3) We find a new opportunity that’s significantly better than something we own in the portfolio.

In general, we scale into our positions over time, starting with a 1-2% weighting at initiation and increasing to 10-15% when we develop enough conviction (which is rare). There is typically a lot of turnover in the smaller positions, but we tend to hold the larger ones for several years.

Anything in particular you’re observing now in this market?

I consider myself a bottom-up stock picker, so I don’t spend much time on the macro stuff and trying to predict the economy or what the market will do. However, I’ve noticed lately that there’s a growing disconnect between smallcap and largecap valuations. The S&P 500 is currently trading at 26x trailing P/E, while smallcaps (using the Russell 2000 index as a proxy) are trading at only 12x. This is a massive gap in absolute terms and relative to Russell 2000’s historical mean of 17-18x P/E.

I’ve been noticing the same…

Yeah. The market can stay irrational for longer than we hope or expect, so I’m not saying this will change tomorrow. But I believe that this gap has to narrow or close entirely at some point, which would lead to a significant outperformance of the small/microcap asset class. I’m personally extremely bullish on microcaps with a long-term horizon.

Thanks for this interview, Mathieu. It’s been great to catch-up, learn more about you and the Rivemont MicroCap Fund. Yours is a most interesting and inspiring story. But outside the investing world, what do you do for fun?

I run ultramarathons in the mountains. I’ve run a few 50-80km trail races, and my longest one was 106km. Those events can take up to 15-18 hours to complete and not only require being in excellent physical condition but also having the mental strength to suffer for extended periods. The grit and perseverance I developed through running are very helpful when enduring the stock market’s volatility, especially after the past couple of years of extreme suffering for us microcap investors.

I love the grit and can-do attitude! Any closing comments?

Late in every race, I tell myself just to keep putting one foot in front of the other. Moving forward is the only way to reach the finish line eventually. When I do, the pain will subside and my body will recover before attempting to climb bigger mountains the next time. You can apply the same thinking to microcap investing. The bear market will end at some point. Microcaps will recover and go on to reach higher peaks. We just have to stay in the game long enough by holding or finding great companies to own!

Thanks, Mathieu.

(Want to contact Mathieu? mathieu.martin@rivemont.ca)

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

You must be logged in to post a comment.