DOLLARAMA 💚S MEXICO

🔎 Buried deep inside Dollarama’s Q4 earnings released April 3rd, 2025 was the company’s announcement that $DOL’s majority-owned Latin American banner, Dollarcity, will now open its “first stores” [plural!] in Mexico in the summer of 2025 [yep — this year], faster than initially planned [i.e, 2026] “as a result of accelerated planning efforts.”

This underscores Dollarama’s recent, and aggressive international push to seemingly become the World’s Dollar Store. Case in point; Dollarama’s acquisition of Australian store chain “The Reject Shop” just a couple of weeks ago.

Here’s what’s interesting; Pesorama $PESO.v – a fellow Canadian company – has been opening their “Joi Dollar Plus” stores across Mexico City since 2018/19; its founder Rahim Bhaloo understood the massive untapped opportunity in Mexico early on, years before behemoth Dollarama.

In a story featured in the Financial Post, Rahim, a Toronto-native and lifelong entrepreneur, said that he struggled for hours to find a gift bag for a birthday party that his daughter was to attend in Mexico City (where Rahim + family had moved to). And from that struggle hatched the idea to open dollar stores, which look and feel a lot like Dollarama stores, throughout Mexico City (have a look for yourself by searching “Joi Dollar Plus” in Google Maps)

Notably, Dollarama’s original governance terms with Dollarcity did not include Mexico – can you believe that? 😁 It was only recently in Fiscal Year 2025 that Dollarcity and Dollarama agreed on updated governance terms as part of the ‘Dollarcity Transaction’, which provide for, among other things, “the future expansion of the business into Mexico”.

Fast forward to today; Mr. Bhaloo opened the 25th Joi Dollar Plus store in Dec 2024, and the company plans further expansion throughout Mexico City, with a sprawling 23,000,000 population — the 7th largest mega-city in the world!

This all begs the question; could Pesorama $PESO.v be a takeover target for Dollarama in the future? Regardless, Dollarama’s now aggressive push into Mexico most likely validates the business case that it’s a crucial, and largely untapped market — but can multiple store chains co-exist?… time will tell.

(Ownership Disclosure: $PESO.v – yes)

stock market

Canada’s Outsider CEO Bob Dhillon: The Radically Rational Blueprint for Mainstreet Equity’s $MEQ Outstanding Success

InvestingIf I were to write the Canadian edition of “The Outsiders”, Bob Dhillon, Founder of Mainstreet Equity Corp. would easily be one of the unconventional CEOs I would feature…

🤔 Why? Well, Mainstreet Equity $MEQ might be one of Canada’s best kept secrets….

✅ 18K+ suites across Western Canada

✅ Owner-operated, with long term focus

✅ Publicly traded since 2000 w/ low hype

✅ Underfollowed by most investors

✅ Growth without share dilution

✅ 18% cash flow growth annually

✅ 13 quarters of double-digit growth

✅ High insider ownership (~50%)

✅ Strategically not structured as a REIT

✅ Benefits from Alberta’s cont. population boom

📈 What about stock performance? In a 20-year (2000 – 2020) stock performance comparison, Mainstreet Equity $MEQ.TO outperformed Amazon, Berkshire Hathaway, and Royal Bank of Canada. Wow!! 🤯

💜 As for philanthropy, Bob’s very giving… in 2018 he made a $10 million donation to the University of Lethbridge – the largest donation in the university’s history. The money is being used by the newly named Dhillon School of Business.

Learn more about Mr. Dhillon and Mainstreet Equity Corp in my conversation with $MEQ investor Jordan Zinberg, video is below ⤵️ Enjoy!! 🍿

(P.S. if you haven’t heard the lightbulb 💡 story, you’re in for a treat; it’s one of the many reasons that set Bob Dhillon apart…)

Ownership Disclosure: $MEQ – Yes

Best Kept Secret on the TSX: Pinetree Capital $PNP & CEO Damien Leonard — Mark Leonard’s Son

InvestingYou’re in for a treat. My friend from across the pond – Alex – has a real knack for deep dives on underfollowed companies. Follow him on X here: Simeon Research.

Alex is a full-time investor, investing for the long term in quality companies within tech, healthcare, and insurance.

And he loves Canada. 3 holdings from his portfolio are $CSU, $TVK, and $VHI …

Large Caps: $CSU.TO – 30% $GOOG – 14% $AMZN – 14% $BRO – 9% $ASML – 5%

Mid Caps: $KNSL – 5% $MEDP – 5%

Small Caps: $NXSN.TA – 5% $TVK.TO – 5% $VHI.TO – 4% $HIMS – 4%

I asked Alex to perform a deep dive into a little-known company traded on the Toronto Stock Exchange: Pinetree Capital ($PNP). I don’t see much talk about Pinetree anywhere, and that’s more surprising when you find out who it’s helmed by… none other than Mark Leonard’s son – Damien Leonard. (Mark being the Founder & CEO of Constellation Software)

Here’s a recent photo of Damien Leonard below (the glorious beard is genetic by the way, and I believe its growth is correlated with gains in the share price of $PNP).

But time will tell…

Photo of Damien Leonard, CEO Pinetree Capital

Pinetree Capital Deep Dive:

Pinetree Capital (PNP.TO): A Unique Approach to Venture Capital

Written by: Simeon Research

Basic Data:

– Market Cap – $107 Mil

– Share Price – $11.5

– P/E – 5.72

– Revenue CAGR 3yr – 57%

– Gross Margin – 100%

Overview

Pinetree Capital operates as both a venture capital and private equity firm, specializing in a diverse range of investments, from early-stage ventures to mature companies. The firm focuses on micro and small-cap companies, believing they offer more attractive risk-to-reward opportunities.

It’s important to note that before 2016, the company operated as a resource management firm until it was acquired and transformed into an investment vehicle. Now, it invests in companies across the software, finance, and healthcare sectors. These industries provide excellent opportunities for vertical applications and niche-focused enterprises.

It’s important to note that software is absolutely essential for companies to operate effectively in today’s world, but I will discuss that further in the next chapter.

Investment Criteria

As a company that invests in others, the philosophy guiding its investment decisions is closely tied to its success.

Their principles go as follows:

A) They stick to their area of competence meaning they only work for companies they understand and have insight on

B) They only have 8-12 investments.

C) No controlling stakes, they trust the management they picked to deliver over a long period of time.

D) Long term oriented

E) Buy at a discount relative to the intrinsic value of a company!

F) The primary focus is of course equity, and occasionally debt and convertible securities.

G) While they avoid intervening with the companies / management, if the situation arises, they will provide strategic counseling.

H) Equity Positions fluctuate between 7-12% of the total assets owed although they state this may at times exceed 20%.

I) Mission Critical Software and Services

I can clearly see here parallels between Pinetree and Constellation software which makes total sense given that the President of Pinetree is Damien Leonard the son of the GOAT of compounding; Mark Leonard (Constellation Software), I really like this direction but we have a lot more to cover.

Down the Rabbit Hole

If you recall the company before 2016 was a resource management company but the changes that happened after that really interested us.

CEO Richard Patricio was replaced by Peter Tolnai an activist investor who bought a 31% stake in the company through the open market. All previous board members and staff were replaced.

The next move was a share consolidation of 100:1 bringing the shares outstanding to 4.5 million.

After this in 2017, Tolnai stepped down from being the CEO of Pinetree, and here where Damien Leonard was bumped up to the CEO position while previously holding a COO position at the company.

It is worth mentioning that even though Tolnai stepped down he reduced his stake to just 7.8% to L6 Holdings (which is run by the children of Mark Leonard, the name L6 is actually L from Leonard and 6 is the number of Leonards involved!). After some research, I found that L6 owns around 1,000,000 shares of CSU, so the ties of Pinetree with the Leonard family are closer than actually meets the eye.

To strengthen this argument even further we can see in 2023 in the case of Quorum Information Technologies; L6 & Pinetree both invested. A total 25.5% stake (11% Pinetree and L6 14.5%).

We have even seen Pinetree buying a 2.6% stake in a company like Sygnity which is considered the CSU of Poland that has a very similar approach to investing. The ties and inspiration from Constellation Software are surely there and play an important role in Pinetree’s success.

Moat

It is essential for every business to have a unique approach or competitive edge that sets it apart and enables it to grow beyond expectations.

In the case of Pinetree, I can identify several key areas that could be considered an advantage.

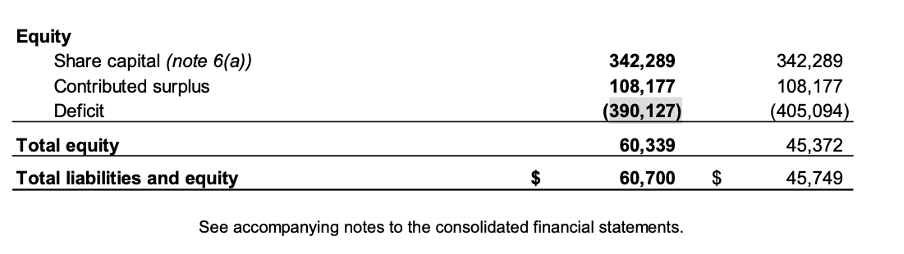

First, we need to discuss the legacy investments situation, as they are the cornerstone of Pinetree’s strategy. Pinetree reports losses amounting to 390 million CAD, which are listed under the Deficit section of the equity balance sheet.

From Q3 2024

I can hear you thinking how this could help them in any way. This deficit is very cleverly used to offset any capital gains from sales of legacy investments.

So if for example they own shares in company A and those shares are sold for a 10 million profit they will pay 0 tax and the deficit is reduced by 10 million so it will be 380 million.

The only exception is actual income but since they only operate as a holding company it’s a free way to have 0 capital gain tax until the deficit runs out.

I also consider an advantage the fact that they are not limited in any way in their investments they can invest in whatever fits their criteria. Most funds are limited by the size of the equities they can invest in; geolocation, liquidity, industry, etc., the fact that they are not gives them a slight edge over competitors.

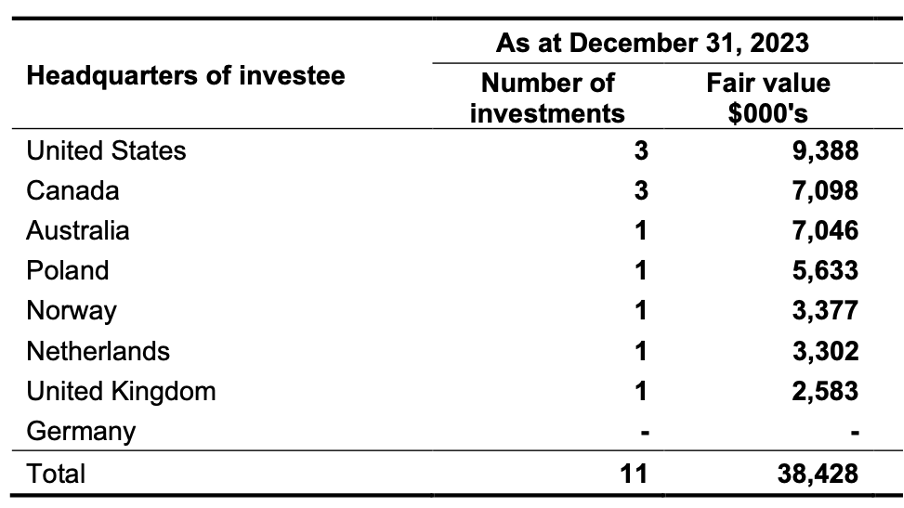

I would call this a risk-agnostic approach! We can see they have investments in the US, Canada, Australia, Poland, Norway, Netherlands, UK, and Germany where most funds are focused exclusively on the United States. However, we will analyze their stock portfolio in the next section.

It is also important that they take an approach of being more concentrated thus focusing more on quality companies with a niche twist towards companies with vertical software solutions.

I would also consider the area of expertise as a key element of their potential success. Vertical software is something I am very familiar with being a $CSU shareholder for a long time. Vertical software not only is less crowded than the broad software market, meaning you can hunt deals more easily and acquire companies at lower multiples, but you can also build expertise. As Pinetree completes deals they can develop great expertise in specific verticals inside the software market helping identify better opportunities.

I can actually write a separate article on why vertical software is one of the best areas to hunt for acquisitions. They have higher retention of clients because the software is essential to run their business thus; very strong retention, pricing power, and very long customer lifetime value. This way there’s more predictable FCF as the revenue is recurring! The retention is reinforced even further by the fact that most vertical software is tailored for the specific needs of each client, this also makes them able to command higher prices and profit margins! Not only that but also vertical software companies are very aware of specific regulations (especially in sectors like finance and healthcare) so they have a deeper understanding of the software needed from the clients further strengthening retention and a closer relationship.

I favour that Pinetree has decided to own companies operating in these niche fields within the vertical ecosystem as it can yield them great profits in a long-term timeframe.

The fact that they haven’t ever sold an investment at a loss speaks volumes of their strict criteria and discipline. It is very positive that their interest is aligned with shareholders with insiders owning 43% of the company.

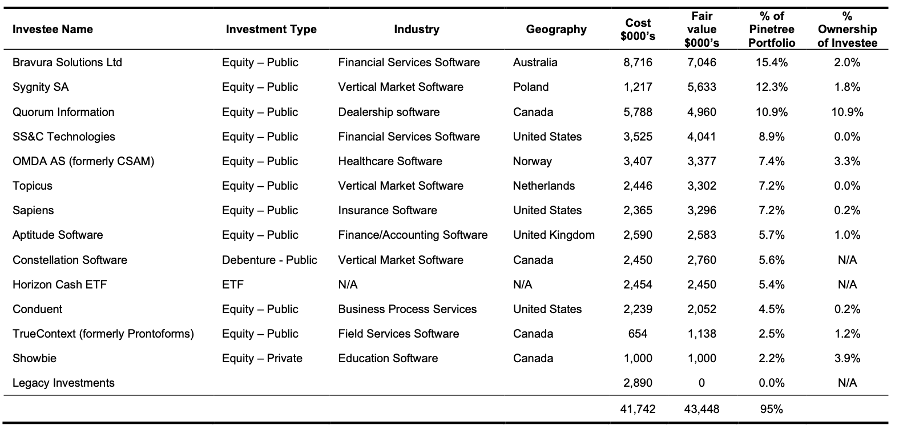

Portfolio

Let’s go through their stock holdings and analyze selected ones.

According to their fillings as of December 31, 2023, Pinetree owns 10 public equity positions and 1 private, and in the legacy section, we have 7 investments (carried over) where the company considers their real value to be 0.

Pinetree’s largest current position is Bravura Solutions, a software applications company for the wealth management and funds administration sectors in Australia; operating software to manage wealth, insurance, pensions, accounting, and more! We can clearly see the niche focus we explained earlier in the moat section.

Sygnity, the Constellation software of Poland couldn’t be missing from here of course being 12% of the portfolio. We can clearly see a theme of owning even more companies that own vertical software companies, like: Constellation Software, Sygnity, and Topicus. As stated previously they follow the recipe of Mark Leonard; their philosophy is deeply rooted in his principles. Sygnity makes solutions for Banking, Energy, and Public administration. Specifically, it makes Video and voice solutions, Telemedical platforms, document co-browsing, secure messaging, metering systems, and forecast software. Their operation is very well diversified. When it was acquired, Pinetree helped them cut down nonrecurring businesses and restructure bad debt inherited from previous owners (exactly like they did). Then Sygnity moved towards an m&a growth model to further emphasize long-term growth combined with organic growth.

Another company I was impressed with is SS&C, a company providing operating software for businesses, portfolios, taxes, and assets. It is in their words the largest independent hedge fund and private equity administrator in finance and healthcare (a main focus area of Pinetree).

OMDA is one of their best investments in the healthcare software space with solutions on LIMS (laboratory information systems), medication management, connected imaging analysis, emergency, and of course health analytics. One of the key things regarding this company is a common theme we see throughout our analysis: they are very aware of the regulations and special needs of companies in such a regulation-driven industry. A true vertical software play.

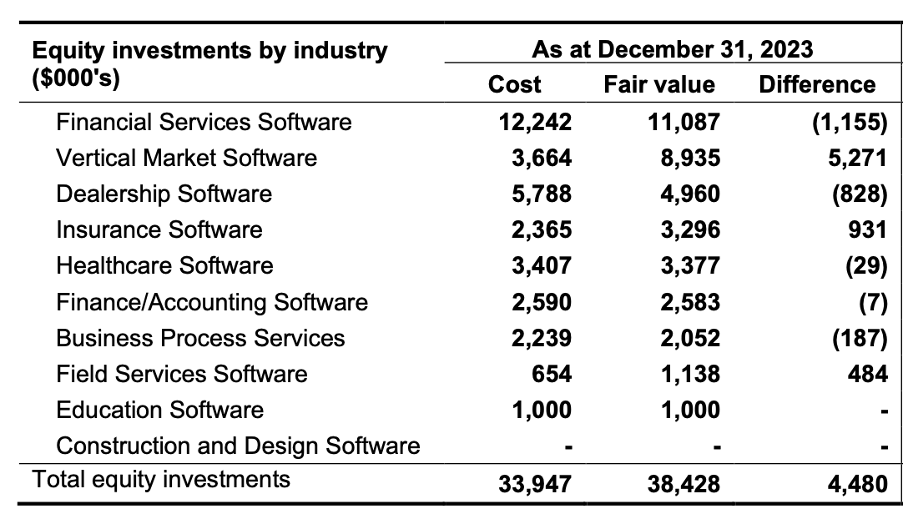

Separated by sector we can see a big focus on financial software and dealership software. They come even before vertical software.

This really intrigued me and I found the reasons why more than half of their portfolio is concentrated there.

The software breakdown goes as follows:

Pinetree Capital Annual Report, 2024

The geographical diversification goes as follows:

Pinetree Capital Annual Report, 2024

Observations

Their stock portfolio, although seems to be concentrated, is indirectly very diversified because a lot of its holdings hold multiple other vertical companies of all sizes across the world of multiple market caps. I can also observe that indeed they stick to their area of niche expertise. They have very smartly positioned themselves towards favorable long-term trends.

Final thoughts

The control leverage Pinetree can achieve due to its ties with Constellation Software, its partners like L6, and other active shareholders is commendable.

Cheers,

Alex

Simeon Research

***

Regards,

Robin Speziale

(Ownership Disclosure: $PNP – Yes)

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

10X Stocks: The Science Behind Multibaggers w/ Ryan Telford

Capital Compounders ShowEnjoy the interview! 🍿👇 In this conversation, Ryan Telford shares his insights into microcaps, focusing on the quant approach he employs to identify potential 10X stocks. He discusses his journey into the world of investing, characteristics of high-performing stocks, and the importance of factors such as sales growth, ROIC, and free cash flow. Ryan also addresses common misconceptions, and introduces “GUTS”.

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

How to Discover MicroCaps Early: A Conversation with Roger Dent

Capital Compounders ShowEnjoy the interview! 🍿👇In this conversation, Roger Dent, CEO of Quinsam Capital, discusses his journey in revitalizing Quinsam Capital. He shares insights on discovering hidden gems like California Nanotechnologies and the success of VitalHub through a roll-up strategy. Roger emphasizes the importance of diversification, lessons learned from successful founders, and the dynamics of the energy sector. He also provides advice for aspiring microcap investors and reflects on the current market trends, particularly in AI and the potential for future investments.

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

Contrarian Stocks: How to Earn Superior Returns In The Stock Market (w/ Benj Gallander)

Capital Compounders ShowEnjoy the interview! 🍿👇In this conversation, Benj Gallander (Contra The Heard) discusses his investment strategy; contrarian investing and the significance of tax loss selling season. He emphasizes the importance of discipline. Gallander walks through his crucial point tally system for evaluating stocks. Finally, Benj Gallander reveals his high conviction stocks for 2025.

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

How to Invest Like FRANCIS CHOU: Canada’s Value Investor (RARE 2015 INTERVIEW)

InvestingListen to this EXCLUSIVE & RARE interview from 2015. Francis Chou (founder, Chou Associates) is Canada’s VALUE INVESTOR! An actual early investor (and past colleague) with Francis Chou, a former Bell repairmen, saw his $80,000 grow to $5 million and at the age of 80, will be worth close to $60 million if compounding returns stay consistent. Now, Chou, the deep-value portfolio manager who likes to pay 50 cents on the dollar runs over $1 billion for his loyal investors.

Francis Chou’s Value Investing Lessons:

Relating shopping in India to investing: “It was my job to make sure I was paying the lowest price for the best”

“When you read about great men and women of the past, it is like having a conversation about world affairs in your living It is not only educational but it builds perspective about life and business in general.”

“My first job is to check whether the company in question meets my investment criteria. It could be a good company, a bad company, or it could be a CRAP [cannot realize a profit].”

“I do screens, read a lot, and talk to other talented portfolio managers to see where they are seeing bargains. . . . [And] before you make a purchase, you should look for investors who are negative.”

“Whenever the majority of investors are purchasing securities at prices that implicitly assume that everything is perfect with the world, an economic dislocation or other shock always seems to appear out of the blue. And when that happens, investors learn, once again, that they ignore risk at their own peril”

“We continue to diligently look for undervalued stocks and will buy them only when they meet our price criteria — in other words, when they are priced for imperfection.”

“I’m trying to buy 80 cents for 40 cents. It does not matter whether they are good companies, bad companies, or distressed”

“You’re a businessman . . . you ask, ‘If I were to buy this company, how much would I pay?’”

“Sustainable earning power, business moats, and competitive advantage relate more closely to intrinsic value and therefore are more important than just increases in book value”

Making Fast Food Fun Again: Happy Belly Food Group ($HBFG) Growth Mode! (Interview with Co-Founder & CEO Sean Black)

Capital Compounders ShowEnjoy the interview! 🍿👇 In this conversation, Sean Black, Co-Founder and CEO of The Happy Belly Food Group, discusses the journey of Happy Belly, successful acquisition of Rosie’s Burger, and expansion plans for Heal Wellness and Yolks among their other growth brands. Sean shares insights on his early career, and the importance of M&A discipline in driving growth at Happy Belly. Sean discusses the importance of aligning interests with shareholders, transparency in operations, and a strong growth strategy. He shares insights on the company’s expansion plans (e.g. US / Florida), and the cultural and people connection that drives the business.

Ownership Disclosure: $HBFG – No

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

Jesse Livermore’s 21 Trading Rules: Secrets of a Wall Street Legend Who Was Once America’s Top Stock Trader

InvestingIn this video, I’m going to reveal Jesse Livermore’s 21 Trading Rules:

Jesse Livermore was one of Wall Street’s most legendary stock traders. Known as the ‘Boy Plunger’ and the man who famously shorted the market during the 1929 crash, Livermore’s story is a rollercoaster of astronomical success, devastating losses, and timeless lessons for traders.

Livermore was a self-taught trading prodigy who made – and lost – fortunes during some of the most volatile times in market history. Most famously, he made $100 million shorting the market during the 1929 crash. At his peak, Jesse Livermore was worth what would equate to $1.5 billion today. What makes him even more legendary is that Livermore traded on his own, using his own funds, his own system, and not trading anyone else’s capital. Livermore started trading at the age of 14, making his first profit of $3.12 at the age of 15 and $1,000 later at that same age. At age 20, he made $10,000, and then the rest is history…

Now let’s get into Jesse Livermore’s 21 trading rules. These aren’t just rules – they’re a blueprint for navigating the unpredictable world of the stock market. And make sure you listen until the end, because I’ll also share with you Jesse Livermore’s little-known book – published close to 100 years ago – and available again now.

Jesse Livermore’s 21 Trading Rules

Rule #1: Nothing new ever occurs in the business of speculating or investing in securities and commodities.

Rule #2: Money cannot consistently be made trading every day or every week during the year.

Rule #3: Don’t trust your own opinion and back your judgment until the action of the market itself confirms your opinion.

Rule #4: Markets are never wrong – opinions often are.

Rule #5: The real money made in speculating has been in commitments showing in profit right from the start.

Rule #6: As long as a stock is acting right, and the market is right, do not be in a hurry to take profits.

Rule #7: One should never permit speculative ventures to run into investments.

Rule #8: The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.

Rule #9: Never buy a stock because it has had a big decline from its previous high.

Rule #10: Never sell a stock because it seems high-priced.

Rule #11: Become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction.

Rule #12: Never average losses.

Rule #13: The human side of every person is the greatest enemy of the average investor or speculator.

Rule #14: Wishful thinking must be banished.

Rule #15: Big movements take time to develop.

Rule #16: It is not good to be too curious about all the reasons behind price movements.

Rule #17: It is much easier to watch a few than many.

Rule #18: If you cannot make money out of the leading active issues, you are not going to make money out of the stock market as a whole.

Rule #19: The leaders of today may not be the leaders of two years from now.

Rule #20: Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from the general trend.

Rule #21: Few people ever make money on tips. Beware of inside information. If there was easy money lying around, no one would be forcing it into your pocket.

And there you have it – Jesse Livermore’s 21 trading rules, each one offering a wealth of wisdom that still holds true today. From managing your emotions to staying disciplined, these rules go beyond just trading strategies – they’re about developing a mindset for long-term success.

But remember, Livermore’s life was also a cautionary tale. Even with all his knowledge, he struggled with the emotional and psychological pressures of trading, which ultimately led to his tragic death. Let his lessons guide you, but also remember the importance of balance and mental health in your own journey.

Like I mentioned earlier, it’s not very well known, but Jesse Livermore is the author of a book called “How to Trade in Stocks“, published in 1940 – almost 100 years ago.

Powering The Oil Patch: Enterprise Group $E (Interview with Co-Founder & President Des O’Kell)

Capital Compounders ShowEnjoy the interview! 🍿👇 In this conversation, Des O’Kell, president and co-founder of Enterprise Group, discusses the resilience and strategies of his company in the cyclical oil and gas industry. He reflects on the challenges faced during downturns, particularly from 2014 to 2021, and how the company managed to remain cashflow positive. Des highlights the shift towards natural gas power systems, the importance of innovation, and the potential for growth in adjacent industries like mining. He also addresses the impact of global markets on Canadian energy and the company’s strategic planning for future growth, including acquisitions and market positioning. Finally, he shares insights into the governance of Enterprise Group and the expertise of its board members.

Disclosure: Enterprise Group ($E) – No

DISCLAIMER: This content is for informational purposes only, and should not be construed as offering of investment advice or stock recommendations. This content is based on the author’s independent analysis and research and does not guarantee the information’s accuracy or completeness. The information contained in this video is subject to change without notice, and the author assumes no responsibility to update the information contained in this video. All information contained herein this video should be independently verified with the sources and companies mentioned. The author is not responsible for errors or omissions. The author does not purport to tell or suggest which investment securities viewers should buy or sell for themselves. Those viewers seeking direct investment advice should consult a qualified, registered, investment professional. The author is not a professional or financial advisor, and does not provide financial advice. Viewers are advised to conduct their own due diligence prior to considering buying or selling any stock. The author will not be liable for any loss or damage caused by a viewer’s reliance on information obtained in any of this content. It’s important to understand that investing involves risk, including loss of principal. The author is not engaged in any investor relations agreements with any of the publicly traded companies mentioned. The author does not receive compensation of any kind from any publicly traded companies that are mentioned in any of this content. The author has acquired and may trade shares of some of the companies mentioned through open market transactions and for investment purposes only. Refer to the “author’s ownership disclosure” where applicable. There may be affiliate links to Amazon, and other companies in which the author is compensated if any of the affiliate products are purchased from Amazon.ca/.com or any other companies.

You must be logged in to post a comment.