Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

The battle for dominance in Mexico’s under-developed dollar store market is intensifying, with two Canadian retailers – Pesorama (“JOi Dollar Plus” stores) and Dollarama (via the Dollarcity banner) – planning expansion across the country, targeting Mexico’s burgeoning budget shoppers.

Operating only 800 stores across Mexico, the domestic incumbent is Waldo’s Dollar Mart. Compare that 800 count to Dollarama’s 1,500+ store footprint in Canada – with its 40M population vs Mexico’s 130M (more than 3x) – and it’s clear to see that there’s opportunity for multiple dollar store players to expand throughout Mexico. The future leadership position, though, is now up for grabs.

While both Pesorama and Dollarama have ambitious plans, let’s not rule out the Americans, of course. Dollar General recently celebrated its international expansion into Mexico with its first “Mi Súper Dollar General” store grand opening in early March 2023.

Just how big is the Dollar Store opportunity in Mexico? Pesorama, which already operates 23 JOi Dollar Plus stores across Mexico, estimated in their October 2022 Investor Presentation that there could eventually be room for “13,700+ dollar stores in Mexico”. This might be possible given how many dollar stores currently operate profitably throughout North America and LATAM (see below).

Source: October 2022 Pesorama Investor Presentation

Further, the Mexican retail market size is estimated at USD $94.40 billion in 2024, and is expected to reach USD $122.70 billion by 2029, growing at a CAGR of greater than 5% during this period (i.e., 2024-2029).

Mexico is a big deal.

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

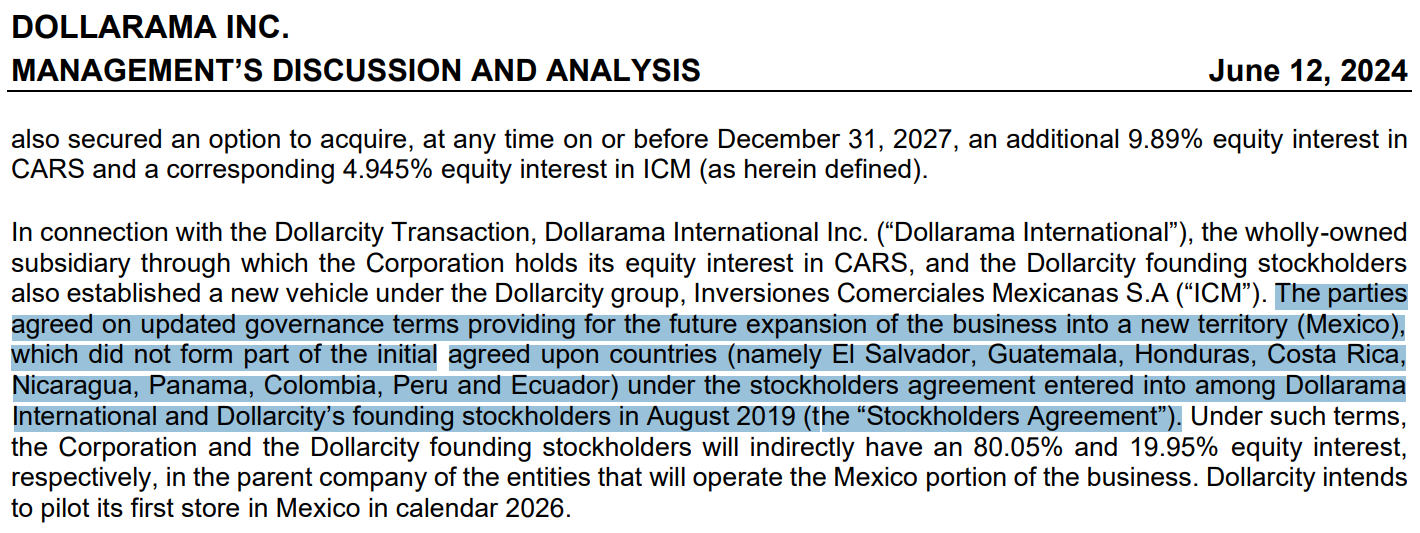

Is Dollarama late to the party, and catching up? What I find most interesting is how Dollarama announced their expansion plans into Mexico, leading me to believe that the Canadian dollar store juggernaut is possibly now playing catch-up. In Dollarama’s Q1 2025 Management Discussion & Analysis (June 12, 2024), management admitted that:

“[Mexico] did not form part of the initial agreed upon countries (namely El Salvador, Guatemala, Honduras, Costa Rica, Nicaragua, Panama, Colombia, Peru and Ecuador) under the stockholders agreement entered into among Dollarama International and Dollarcity’s founding stockholders in August 2019 (the “Stockholders Agreement”)” (see that excerpt below)

Source: Q1 2025 Dollarama Management Discussion & Analysis

Perhaps Pesorama’s entry and expansion of its JOi Dollar Plus stores across Mexico, including other new entrants (e.g. Dollar General), caught the attention of Dollarama’s upper management. How could they just sit back and watch? But the better question – i.e., why Dollarama did not originally plan to expand into Mexico, with a population and retail market size far exceeding those aforementioned LATAM countries – is beyond me.

Source: https://www.joi.mx/ubicaciones; JOi Dollar Plus location

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

Dollarama, through the Dollarcity banner, plans to pilot its first dollar store in Mexico in calendar year 2026, giving the competition (both old and new) another ~2 years to expand across the country. The current leader, Waldo’s Dollar Mart, plans to open approximately 70 stores a year going forward in Mexico, meaning that they will be operating close to 1,000 dollar stores around the time of Dollarcity’s first store launch.

Dollarama is placing a big bet on the LATAM region to fuel its future growth, and try to outcompete its peers. As at March 31, 2024, Dollarcity had 547 stores with 324 locations in Colombia, 99 in Guatemala, 72 in El Salvador and 52 in Peru. Dollarcity’s revised long-term store target in these four current markets of operation is up to 1,050 stores by 2031, versus its previous target of 850 stores by 2029. That said, this increased target reflects anticipated growth mainly in Peru and Colombia and does not take into account any future expansion in Mexico.

Current Market Caps of the BIG 3 North American Dollar Stores:

– Dollar General: $25.8B USD

– Dollar Tree: $22.3B USD

– Dollarama: $36.9B CAD

Just how aggressive Dollarama’s Dollarcity push into Mexico will be is still undetermined. Management will most likely reveal their full expansion plan as a result of the first store opening in 2026.

On the crucial importance of LATAM growth for Dollarama, Neil Rossy, President and CEO of Dollarama said on their latest earnings call:

“Dollarcity continues to represent a compelling, long-term growth platform for Dollarama, with the Dollarcity leadership team successfully executing on its strategy throughout the course of our over decade-long partnership… Since we initially acquired a majority equity interest in 2019, Dollarcity has more than tripled its revenues and significantly grown its presence in key LATAM markets, demonstrating the underlying strength of its business model and the appetite for our value proposition from LATAM consumers.”

Indeed, with so much market opportunity up for grabs, the dollar store wars in Mexico are set to reshape the country’s retail sector in the coming years. Waldo’s Dollar Mart, while currently leading, will likely need to innovate and upgrade their existing stores to maintain its market position amid increasing competition from Dollarama, Pesorama, Dollar General, and other international entrants. With these Canadian and American dollar store brands introducing fresh new store formats, compelling customer experience, and a wide-range of products into Mexico, the Mexican consumer will surely benefit from the future dollar store marketplace.

With the rise of dollar store competition intensifying in Mexico, how do you think this will all play out?

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

Author’s Ownership Disclosure: $DOL.to (yes), $PESO.v (yes), $DG (no), $DLTR (no)