Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)

Imagine acquiring a 1%+ stake in a public company for under ~ $1 per share, and then its stock price goes parabolic? The company reaches a billion dollar market cap and makes you a multi-millionaire.

That’s the dream, right?

The beauty of hunting in micro-cap land is that it’s possible, but not guaranteed, of course. (remember: investing is risky)

This MicroCap Success Story happened to a DIY investor named Jason Hirschman who invested early on in Xpel Inc., a company that sells protective films and coatings, primarily for cars; automotive paint protection film, surface protection film, automotive and architectural window films, and ceramic coatings.

Currently holding 1,422,300 (5.150 %) shares in what is now a $2.3 billion market cap company, Jason owns a bigger stake in Xpel than even its CEO – Ryan Pape.

Source: https://www.marketscreener.com/quote/stock/XPEL-INC-16725576/company/

Search “Jason Hirschman” on YouTube and you’ll find lots of info-packed interviews where Jason shares his process. Inspiring, indeed.

Xpel has made more millionaires out of DIY investors, including one of my readers who has asked to just be called “Max”.

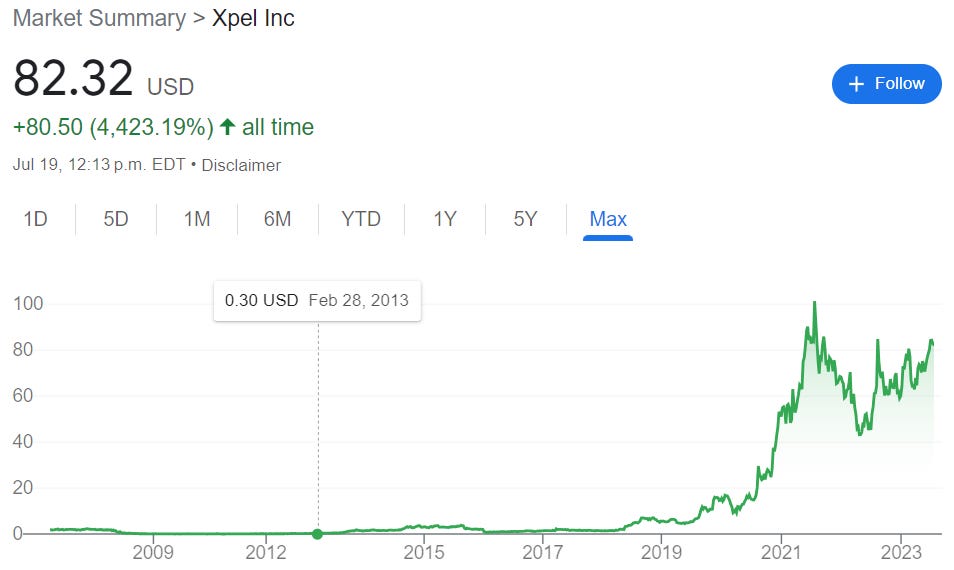

Max started acquiring shares in Xpel at the low cost of $0.31 per share. Now the company trades at a whopping $82 per share in USD as the company voluntarily delisted from the TSX Venture in August 2019 to solely trade on the U.S. Nasdaq exchange.

At the time, Max said that his position in Xpel was worth 7 figures.. but by now it might be well into the 8 figure range unless he sold along the way.

I wrote about Max in my book, Capital Compounders (2018). Here’s the chapter:

***

Rags to Riches (XPEL)

By: Max

In February 2013, XPEL caught my attention as it started to move up ever so slightly. On February 28, 2013, I bought 73,000 shares at $0.31. Why; several reasons:

1. Stock trending higher

2. Very clean company, no options or warrants and large insider position; roughly 30% +

3. Valuation was key; $0.31 x 25 million shares = $7,000,000 market cap

4. Superior software for the cutting of patterns

I rode the wave up and bought and sold till it peaked and turned down. I sold 150,000 shares in total till I was down to 48,000 shares at the end of Dec, 2017. Through 5 years of exceptional revenue growth, the growth didn’t fall to the bottom line and the company was very tight lipped about anything they were doing.

The 3M lawsuit created another opportunity as investors threw in the towel and feared the company would even going out of business. When I compared many companies to XPEL, I found XPEL to be cheap on a revenue to market cap basis compared to 98% of all the other companies I came across.

Post settlement with 3M, I repurchased around 75,000 shares between $1.50 and $2.45. averaging around $2.00. I reinvested around $200,000 Canadian dollars because it was cheap. I did not know if XPEL could execute the business plan but my downside was covered in my opinion. By the way, XPEL did show up on Joel Greenblatt’s screening as a value buy.

I am long 90% of my position still in XPEL. It has become a 7 figure valuation for me in Canadian dollars. All of the stock is in my RRSP and TFSA. So I’m not paying the taxman yet.

The lessons learned and employed were the following:

1. Valuation is key. Don’t put yourself in a position to lose money, although frivolous lawsuits can be a hindrance. Understanding risk is key. Lessons taught by many. Howard Marks resonated with me on that particular point.

2. To make outsized profits, concentrated positions are necessary. Munger and Druckenmiller are examples.

3. Understand the company inside out. This I got lucky with as I was involved from the inception but I kept my eye on the ball the whole time.

4. Liquidate a position on the way down. This allowed me to sell 75% of the position before reloading. This is a Livermore rule. You never know where a top is but you can see it turn.

I don’t ever believe I can do that again but it has been life changing for me. Part of it is being in the right place at the right time. So luck plays a part in it no doubt.

***

Do you have a MicroCap Success story that you want to share? Email me and I’ll publish it in the next newsletter.

Author’s Ownership Disclosure (July 20, 2023): Xpel Inc. (yes)

Subscribe Now to My FREE Newsletter (Join 5,000+ Subscribers!)